Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

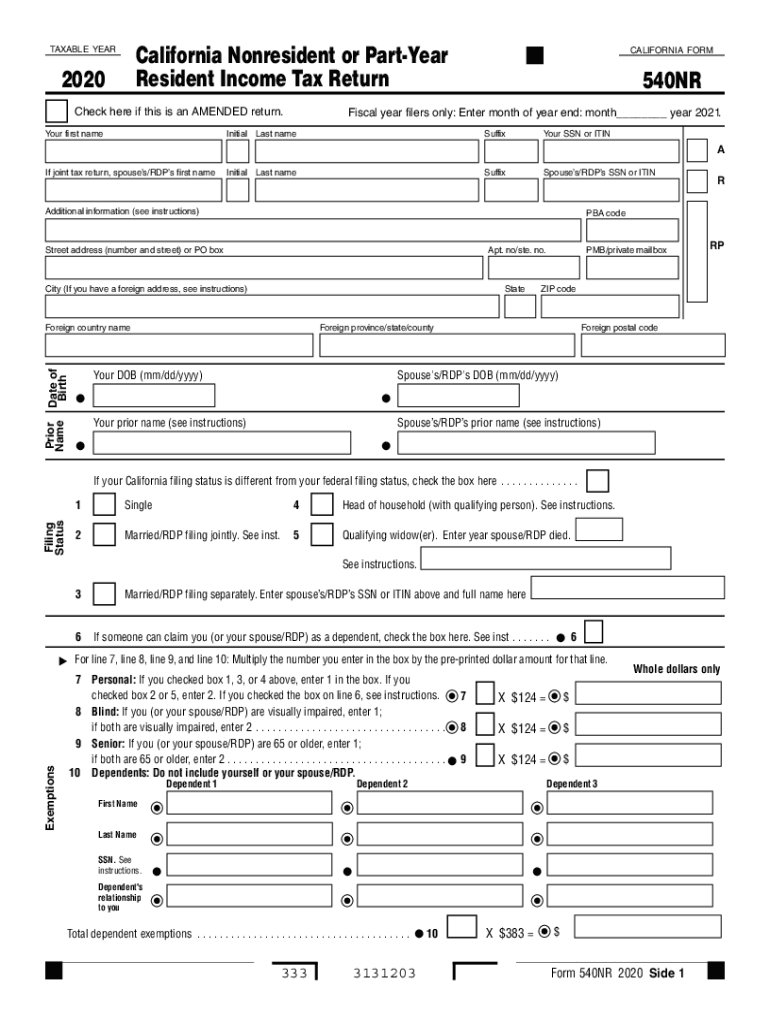

How to fill out form 540nr?

1. Enter your name and address on the top of the form.

2. Enter the applicable federal and state filing information.

3. Enter information about your California residency status.

4. Enter detailed information about your income sources, such as wages and self-employment income.

5. Enter information about any applicable deductions and credits.

6. Calculate your total California adjusted gross income.

7. Calculate your California taxable income.

8. Calculate your total California tax.

9. Sign and date the form.

10. Submit your form to the California Franchise Tax Board.

What is the purpose of form 540nr?

Form 540NR is California's Nonresident or Part-Year Resident Income Tax Return. It is used by non-residents and part-year residents of California to file their state income taxes.

What information must be reported on form 540nr?

Form 540NR, the California Nonresident or Part-Year Resident Income Tax Return, requires the following information to be reported:

1. Personal information, including name, Social Security Number (SSN), address, filing status, and the number of dependents claimed

2. Wages, salaries, tips, and other compensation

3. Interest, dividends, and other investment income

4. Capital gains and losses

5. Pension and annuity income

6. Rental income and expenses

7. Business and farm income and expenses

8. Gambling winnings and losses

9. Other income

10. California adjustments to income

11. Tax credits

12. Payments made

13. Estimated tax payments

14. Amounts from federal forms

15. Any other information required by the Franchise Tax Board.

When is the deadline to file form 540nr in 2023?

The deadline to file Form 540NR in 2023 is April 15, 2024.

What is the penalty for the late filing of form 540nr?

The penalty for late filing of California Form 540NR is 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25%.

Form 540NR is the California Nonresident or Part-Year Resident Income Tax Return. It is used by individuals who are nonresidents of California but have income from California sources, or who are part-year residents and have income from both California and non-California sources. This form is used to report and calculate their California income tax liability.

Who is required to file form 540nr?

Form 540NR is typically filed by individuals who are nonresidents or part-year residents of California for tax purposes. This includes individuals who earn income in California but do not live in the state year-round. Additionally, individuals who are residents of California but earned income outside of the state may also need to file Form 540NR. It is important to consult the instructions and guidelines provided by the California Franchise Tax Board or a tax professional to determine if Form 540NR must be filed in a specific situation.

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the form 540nr in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete california 2020 540nr on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your ca 540nr 2023, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out 540nr on an Android device?

Use the pdfFiller mobile app to complete your ca form 540nr 2023 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.